Gold hovered near two-week lows on Friday as a rebound in the dollar dampened bullion's appeal as a currency hedge while investors were becoming wary of speculative long positions building in futures. Some traders said that notably slow growth in gold-backed exchange-traded funds compared to the market's rally to 18-month highs suggested investor demand may be peaking, while others expected slack jewellery demand from India, the world's largest consumer of gold. Gold is trading at $998 as of 11:32am, London. Gold’s Pool-Position is 29% Long, meaning that most Finotec clients are selling the precious metal.

Friday, September 25, 2009

Gold Falls as the Dollar strengthens on G20 comments

Energy Futures Commentary

NOVEMBER CRUDE OIL

November crude oil closed down $3.05 at $65.92 a barrel yesterday. Prices closed near the session low again yesterday and hit a fresh nine-week low. Serious near-term chart damage was inflicted yesterday as prices saw a big and bearish downside 'breakout' from the recent trading range at higher price levels. Crude bears now have the near-term technical advantage. The next downside price objective for the crude oil bears is to produce a close below solid technical support at the July low of $61.38. The next upside price objective for the bulls is producing a close above psychological resistance at $70.00 a barrel. First resistance is seen at $66.00 and then at $67.00. First support is seen at yesterday's low of $65.60 and then at $65.00.

Source: VantagePoint Intermarket Analysis Software

NOVEMBER HEATING OIL

November heating oil closed down 774 points at $1.7130 yesterday. Prices closed near the session low yesterday and hit a fresh nine-week low. Prices also saw a bearish downside technical 'breakout' yesterday. Bears have regained the near-term technical advantage. Prices are in a six-week-old downtrend on the daily bar chart. The bulls' next upside price objective is closing prices above solid technical resistance at $1.8500. Bears' next downside price objective is producing a close below solid technical support at the July low of $1.6000. First resistance lies at $1.7356 and then at $1.7500. First support is seen at yesterday's low of $1.7025 and then at $1.6750.

NOVEMBER GASOLINE

November (RBOB) unleaded gasoline closed down 744 points at $1.6467 yesterday. Prices closed near the session low and hit a fresh nine-week low yesterday. Bears have the near-term technical advantage and gained more downside momentum yesterday. Prices are in a six-week-old downtrend on the daily bar chart. The next upside price objective for the bulls is closing prices above solid technical resistance at $1.7500. Bears' next downside price objective is closing prices below solid support at the July low of $1.5026. First support is seen at yesterday's low of $1.6369 and then at $1.6000. First resistance is seen at $1.6750 and then at $1.7000.

NOVEMBER NATURAL GAS

November natural gas closed up 14.0 cents at $4.894 yesterday. Prices closed nearer the session high again yesterday and hit a fresh six-week high. Prices are in a two-week-old uptrend on the daily bar chart. Bulls gained upside technical momentum yesterday, but have more work to do to suggest prices can continue to trend higher. The next upside price objective for the bulls is closing prices above solid technical resistance at the August high of $5.133. The next downside price objective for the bears is closing prices below solid technical support at $4.40. First resistance is seen at yesterday's high of $4.919 and then at $5.00. First support is seen at yesterday's low of $4.665 and then at $4.50.

Dollar vs Gold

It seems a given now that the U.S. dollar is doomed to either slow depreciation or devaluation. Perhaps--but the consensus seems too easy. Yes, money supply and liquidity have exploded as the Fed and Treasury fight deflation, and yes, history suggests expanding the money supply debases the currency.

That the dollar has been debased is clear enough if we measure the dollar's value in gold. Priced in gold, the dollar has lost over 2/3 of its value in a mere decade. Courtesy of contributor Harun I., here is a chart of gold:

Where it took less than $300 to buy an ounce of gold in 2001, it now costs about $1,000. Thus the dollar has lost 70% of its purchasing power when priced in gold.

Correspondent Jim S. observed that this depreciation has been a trend for the entire 20th century:

At the barbershop, the barber asked me if the dollar was at risk of failing. The dollar is not at risk of being wiped out, IT ALREADY HAS BEEN WIPED OUT, and the world is moving on. From 1789 to 1912, the dollar appreciated a full 11%. From 1912 to 2001, it has lost 95% of its value under the fractional reserve banking system of the Fed Reserve, massively overleveraged further since the inventive application of credit derivatives since the ‘90s.

In 2001, a dollar index of $1.2 (as charted by the Dollar Index) existed and now it is at about .76. This recent drop results in a dollar loss greater than 95% from the 1912 value. The dollar HAS been destroyed in the proper historical perspective!

A world-wide move underway, recognizing that the dollar is now unsustainable as a reserve currency, to a new form of reserve currency/currencies, will take some time, and, our dollar will remain as the reserve currency for a while as something new emerges. Regional currencies may evolve in the meantime: Yuan? AMERO? EURO? A worldwide, single, unified currency is too utopian for applicability.

Regional currencies have yet to be proved sustainable either. We are in limbo with a sinking dollar. Geopolitical instability of increasing scope, including at least cultural and resource wars, are in the offing before anything gets settled. Remember the ‘100 years war’?

Indeed, debased currencies and the evaporation of sound money are related to economic and social turmoil. Bankrupt regimes and empires have long attempted to solve the imbalance between their stupendous spending and declining tax revenues by reducing the silver or gold content of their coinage--in other words, "inflating their way to prosperity."

It never worked. Bad money drove out good money, meaning people hoarded gold, silver and sound money and quickly passed off the depreciating "bad" money onto some other sucker.

But the ease of extending this trend in the dollar troubles me. Things rarely turn out as the 97% consensus expects. (By some measures, "dollar Bulls" have been reduced to a near-statistical-noise 3%.)

So let's ask cui bono: who benefits from the collapse of the dollar, and who would benefit from its appreciation?

In general, those with debts to pay would benefit, as debt can be paid with "cheaper" (depreciated) dollars. Those holding the debt would not benefit, as their payments would continue to decline in purchasing power.

So the question boils down to this: who holds the debt and assets? Put another way: who would benefit from the dollar actually rising in value? The answer: the rentier-financial Elites. They're the ones collecting rent and interest payments, and a depreciating dollar is not in their interests at all. The falling dollar benefits those paying down debt (debt-serfs), not those to whom they pay rent and interest.

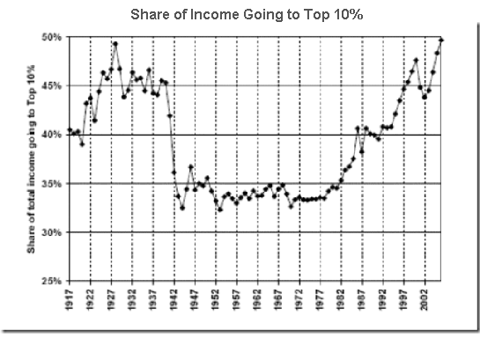

That the top 1% own 2/3 of the productive assets of the U.S. is simply fact, as is the rising level of income inequality. Please consider this chart:

Note that the last extreme of inequality was reached just before the Great Crash of 1929. The dynamic is this: as the rentier-financial Elite (what I call the Plutocracy) over-reaches , then their share of thenational income rises to extremes. Their over-reach creates tremendous imbalances in the financial system, however, which lead to financial crisis.

At that point, the State (central government) places some modest restrictions on the Plutocracy's ability to over-reach (overleverage, fraud, embezzlement, etc.), and income inequality falls.

That the vast majority of the national wealth and income is held by the top 1% of households has been documented in a number of books:

The Rich and the Super-Rich, A Study in the Power of Money Today

(out of print, but used copies are available)

Ferdinand Lundberg

Wealth and Democracy: A Political History of the American Rich

Kevin Phillips

The Power Elite

C. Wright Mills

Who Rules America? Challenges to Corporate and Class Dominance

G. William Domhoff

Strangely enough, the mass media presents the Federal Reserve and the Treasury as "in charge" of the dollar's decline. Those agencies certainly control the strings of money supply and liquidity, but who sets their agenda? The bureaucrats? No, the bureaucrats (Bernanke et al.) are hired hands, following an agenda set by others-- those who control concentrations of wealth and thus political power.

From this perspective, the entire outrageous bailout of the financial sector makes perfect sense. Question: who held most of the stock, bonds and other financial assets which would have been rendered worthless had the sector been allowed to collapse? It wasn't Joe Homeowner; some 80% of the financial assets of the nation are owned by the top few percent of households.

So naturally the agenda sent down to the Congress and bureaucrats was simple: backstop the horrendous private losses with government (taxpayer) funds. The profits were private but the losses must be socialized/passed to the taxpayers. And so it was done, even as the citizenry pounded their "representatives" with emails running 300-to-1 against the gigantic bailout of the stupendously wealthy.

In The Royal Scam, Anonymous Correspondent suggested the rentier-power Elite could shift their assets out of the dollar and then swoop back in after the devaluation to scoop up the assets of the U.S. for a pittance.

That is a scenario worth pondering, to be sure, as it would solve the Federal Governemnt's massive debt at the same time.

But just as a thought experiment, consider the alternative: that the power Elite sets the agenda of a rising dollar. Since the power Elite owns a staggeringly large amount of assets held in dollars, a rise in the dollar would increase their purchasing power as rents and interest are paid in dollars. A decline in the dollar would not serve their interests.

So if a rentier-financial Elite does hold political influence, why have they allowed the dollar to plummet? Perhap their assets and income were growing faster than the dollar was declining. Now that their assets and income are no longer growing faster than the dollar is declining, the agenda is about to change: strengthen the dollar.

Lastly, we might ask who else internationally might benefit from a rising dollar. How about the Chinese, Japanese and oil exporters who hold dollar-denominated debt?

We might also note that exporting nations desperately want a stronger dollar which then weakens their own currencies, making their goods more competitive in the U.S. market.

If we line up all those who benefit from a rising dollar, we find some reason to anticipate a reversal in the dollar's decline.

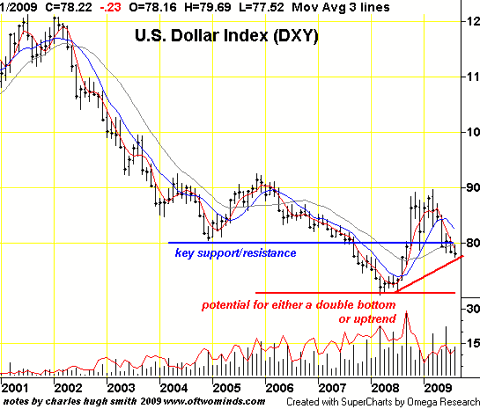

Here is a chart of the dollar:

Technical Analysis for Major Currencies

EURO

The Euro versus Dollar pair slumped yesterday to breach the key support for the bullish channel with the possibility of forming a bearish technical pattern with a neckline at 1.4685 as seen in the above image. Momentum indicators show the pair being oversold which may result in an upside correction to retest the broken level at 1.4755 before reversing back to the downside for today targeting 1.4465. A four hour close below 1.4755 is crucial for the decline to continue.

The trading range for today is among the key support at 1.4465 and the key resistance at 1.5000

The general trend is to the upside as far as 1.4135 remains intact with targets at 1.6000

Support: 1.4610, 1.4565, 1.4515, 1.4465, 1.4410

Resistance: 1.4685, 1.4755, 1.4790, 1.4845, 1.4875

Recommendation: Based on the charts and explanations above, our opinion is selling the pair from 1.4755 to 1.4625 and stop loss above 1.4845 might be appropriate.

GBP

The Cable declined yesterday after confirming the breach of the key support at 1.6190, altering the trend to the downside. Momentum indicators have entered an oversold area making us expect an upside correction to reach the broken level in an attempt to retest it before reversing back to the downside on the short and medium terms with targets at 1.5800 and 1.5400 respectively. A daily close below 1.6190 is needed for the decline to occur.

The trading range for today is among the key support at 1.5555 and the key resistance at 1.6590

The general trend is to the upside as far as 1.4840 remains intact with targets at 1.7100

Support: 1.5895, 1.5800, 1.5775, 1.5700, 1.5615

Resistance: 1.6040, 1.6125, 1.6190, 1.6265, 1.6300

Recommendation: Based on the charts and explanations above, our opinion is selling the pair with the breach of 1.6040 to 1.6190 and stop loss above 1.5965 might be appropriate

JPY

The USD/JPY pair surged to the upside towards 91.60 before gradually reversing to the downside to near the pivot support at 90.35, the neckline for a bearish technical pattern as seen in the above image. This pattern makes us expect a decline on the intraday basis targeting 88.00 as far as 91.75 is intact.

The trading range for today is among the key support at 88.00 and the key resistance at 94.70

The general trend is to the downside as far as 102.60 remains intact with targets at 84.95 and 82.60

Support: 90.35, 89.80, 89.35, 88.65, 88.00

Resistance: 91.25, 91.50, 91.75, 92.10, 92.55

Recommendation: Based on the charts and explanations above, our opinion is selling the pair with the breach of 90.35 to 89.65 and stop loss above 90.95 might be appropriate.

CHF

The Dollar versus Swissy pair inclined to reach the 61.8% correction which resides at the key support for the downside channel between 1.0310 – 1.0320 yet the stochastic indicator as entered an overbought area making us expect a decline on the intraday basis reaching 1.0200. This decline remains valid as far as 1.0325 remains intact on the four hour charts.

The trading range for today is among the key support at 1.0000 and the key resistance at 1.0550

The general trend is to the downside as far a 1.1225 remains intact with targets at 0.9600

Support: 1.0260, 1.0235, 1.0200, 1.0135, 1.0080

Resistance: 1.0310, 1.0390, 1.0425, 1.0480, 1.0550

Recommendation: Based on the charts and explanations above, our opinion is selling the pair from 1.0310 to 1.0200 and stop loss above 1.0390 might be appropriate.

CAD

The Dollar versus Loonie pair surged yesterday opposing expectations to breach the key resistance as seen in the above image to form a bullish technical patter with a neckline at 1.0850. Momentum indicators are providing negative signs which may result in the retest of the above mentioned level before confirming the short term uptrend. From here we expect the pair to incline on the short term targeting 1.1045 and 1.1120 respectively as far as 1.0850 remains intact on the four hour charts.

The trading range for today is among the key support at 1.0425 and the key resistance at 1.1120

The general trend is to the downside as far as 1.1870 remains intact with targets at 1.0300

Support: 1.0850, 1.0765, 1.0700, 1.0655, 1.0625

Resistance: 1.0885, 1.0935, 1.0985, 1.1045, 1.1120

Recommendation: Based on the charts and explanations above, our opinion is buying the pair from 1.0850 to1.0985 and stop loss below 1.0765 might be appropriate

GBP/JPY

Sterling versus Japanese yen collapsed, breaching the detected neckline of our daily double top formation and closing below it. Now, the door is opened for further bearishness on the intraday basis and also the short term basis, targeting 137.55 first. AROON indicator alongside the daily negative structure of the candlesticks as seen on the secondary image supports our bearish scenario.

Trading range for today is among key support at 140.00 and key resistance at 150.50.

The general trend is to the downside as far as 167.40 remains intact with target at 116.00.

Support: 144.80, 144.00, 143.50, 142.75, 141.60

Resistance: 145.50, 146.20, 146.80, 147.30, 148.25

Recommendation: Based on the charts and explanations above our opinion is, selling the pair from 145.25 targeting 142.75 and stop loss above 147.30 might be appropriate.

EUR/JPY

The pair has declined reaching the key support level of 132.50. The negative structure along with the negative signs obtained from Ribbons lines [EMA 10-80] as seen on the secondary image and AROON and RSI 14, offer a potential downside rally resumption in order to breach the above mentioned level to activate the previous discussed internal third wave of Elliott studies to the downside.

Trading range for today is among key support at 130.05 and key resistance now at 136.30.

The general trend is to the downside as far as 141.44 remains intact with targets at 100.00 followed by 88.97 levels.

Support: 132.90, 132.50, 131.80, 131.20, 130.70

Resistance: 133.70, 134.15, 134.85, 135.20, 136.10

Recommendation: Based on the charts and explanations above our opinion is, selling the pair from 133.20 targeting 131.05 and stop loss above 134.95 might be appropriate.

EUR/GBP

About 15 pips separated the pair from our detected technical target of the bullish scenario at 0.9205-check the analysis here-. Now, the daily formation and positive closing of the candlesticks offer further bullishness towards the extended technical targets of the bullish harmonic structure and the cup with handle pattern as seen on the four-hour chart around 0.9260 followed by 0.9370. Hence we keep our overview to the upside on the intraday basis.

Trading range is among the key support at 0.9000 and key resistance now at 0.9375.

The general trend is to the upside as far as 0.8020 area remains intact with targets at 1.0000 followed by 1.0400 levels.

Support: 0.9160, 0.9130, 0.9095, 0.9070, 0.9030

Resistance: 0.9205, 0.9235, 0.9260, 0.9320, 0.9370

Recommendation: Based on the charts and explanations above our opinion is, buying the pair from 0.9160 targeting 0.9255 and stop loss below 0.9080 might be appropriate.

Technical Analysis for Precious Metals

Silver

Silver declined sharply activating yesterday's bearish anticipation via reaching the technical target of 16.25. The daily candlesticks structure as shown on the subsidiary image shows that the metal is still preparing for additional negative actions after a slight correction. The previous breakout occurred below the up trend line of the momentum supports our scenario which is based on the short and medium term negative harmonic formation. Therefore we keep our overview to the downside over the intraday basis.

The trading range for today is among the key support at 14.90 and key resistance now at 17.35.

The general trend is to the upside as far as 10.95 remains intact with targets at 18.50.

Support: 16.10, 16.00, 15.95, 15.82, 15.77

Resistance: 16.32, 16.40, 16.48, 16.57, 16.65

Recommendation: Based on the charts and explanations above our opinion is, selling silver from 16.40 targeting 15.80 and stop loss above 16.90 might be appropriate.

Gold

Gold has declined sharply, reaching the detected technical target of our yesterday's analysis-check the analysis here-. The daily formation helps us to say that additional bearishness is underway for the time being as the technical target of our captured duplicated bearish harmonic pattern resides around 965.00 zones. A slight correction towards 1001 zones is needed before resuming the bearish rally and this upside movement will be seen as a correction inside the major negative direction. Hence we keep our intraday overview to the downside. Indicators support our anticipation.

The trading range for today is among the key support now at 956.00 and key resistance now at 1035.

The general trend is to the upside as far as 820.00 remains intact with targets at 1035.00 and 1044.00.

Support: 992.00, 984.00, 977.00, 965.00, 956.00

Resistance: 1002.00, 1006.00, 1009.00, 1017.00, 1022.00

Recommendation: Based on the charts and explanations above our opinion is, selling gold from 1001.00 targeting 982.00 and stop loss above 1017.00 might be appropriate

Gold and Forex report

Rupee : Rupee bounced back to 48.25 levels today and met exporters selling close to those levels. We expect rupee to be in the range of 47.90 to 48.50 in short term .It has major weekly trend support at 47.80-48.00 till which further weakness in rupee is still supported. ONCE we see the levels of 47.80 breaking the bias of rupee may change to bullishness. Rangebound. (USD/INR : 48.10).

Euro : The EURUSD failed to continue it's bullish momentum yesterday. The pair attempted to push higher, topped at 1.4801 but whipsawed to the downside, closed lower at 1.4660. Although we have serious threat to the current bullish outlook, I think it's too early for a bearish reversal scenario. Today we will pay attention to any reaction around 1.4595 area. Break below that area could be seen as bullish failure while rejection and bounce around that area should keep the bullish scenario intact and give us a good opportunity to place long position with tight stop loss below 1.4595 targeting 1.4800 area.(EUR/USD 1.4686) Bullish.

Sterling : The GBPUSD had a significant bearish momentum yesterday. The Sterling is in heavy pressure right now and staying below 1.6000 psychological level could hurt the Sterling really bad and might cancel the bullish scenario targeting 1.5800 and 1.5700 area. However, a rejection to move below 1.5900 could trigger an upside rebound testing 1.6113 resistance area but we think now is not the best time to place a long position. GBPUSD reached a significant resistance at 1.6400 levels.(GBPUSD 1.6000) Bearish

Yen : The USDJPY attempted to push lower yesterday, bottomed at 90.35 but further downside pressure was rejected as the pair closed higher at 91.24. The 90.20 support area once again proved to be a good support level at this phase. We prefer to sell around 92.50 and to buy around 90.20. Overall bullish. (range trading).(USD/JPY 90.63) Bullish

Aud : Aud maintains the bullish bias. Buying at dips close to important supports remains the best strategy in the current market scenario.Only a continuous move below 0.8400 would break the trendline and stand bearish for the pair. (AUD/USD -0.8690) Bullish

Gold : Gold prices plunged down to $990 due to the dollar strengthened on speculation Group of 20 leaders will agree to tighten capital requirements. Buy on dips is the strategy fom $990 levels for the target of $1005.(Gold - $997.40). Bullish

Dollar Index : The Dollar Index (basket against 6 currencies with EUR accounting for 57% of the basket) needs to break the levels of 78.70 to maintain strength again otherwise rangebound. It could bottom close to 75.50 levels. (Dollar Index - 76.85).Neutral

FX Technical Analysis

EURUSD

Comment: Retreating from this year's high at 1.4845, still clearly above the most recent Fibonacci retracement. Allow for more sideways work today where a weekly close above 1.4700 is needed to maintain current decent levels of bullish momentum.

Strategy: Buy at 1.4690; stop below 1.4600. Add to longs on a break above 1.4800 and again above 1.4855 for 1.5000 medium term and more long term

Direction of Trade: →

Chart Levels:

| Support | Resistance |

| 1.4650 " | 1.47 |

| 1.4614/1.4600* | 1.4765 |

| 1.456 | 1.48 |

| 1.45 | 1.4845* |

| 1.446 | 1.49 |

GBPUSD

Comment: Gathering downside momentum as we break below trendline support, as feared. The question now is which of the three longer term Fibonacci retracement support levels will limit this correction lower. These lie between 1.5700 and 1.4850. Note that the move has been caused by sterling weakness caused by central bank comments as well as fears over the banking system and its long term outlook.

Strategy: Do nothing. Possibly try and trade the range between 1.5900 and 1.6200

Direction of Trade: →

Chart Levels:

| Support | Resistance |

| 1.5917 " | 1.6062 |

| 1.58 | 1.61 |

| 1.5775 | 1.62 |

| 1.5700* | 1.635 |

| 1.55 | 1.647 |

USDJPY

Comment: Trading just below the nine-day moving average and looking set to drop towards 90.00 again. A weekly close below 90.00 should ensure downside pressure is maintained for a re-test of very important very long term support between 87.10 and 85.00. Note that the US dollar is not oversold.

Strategy: Attempt shorts at 90.65, adding to 91.30; stop well above 91.65. Short term target 90.35/90.00 and then scarily lower still. Remember: the lower we go the greater the temptation to interfere.

Direction of Trade: →

Chart Levels:

| Support | Resistance |

| 90.56 " | 91 |

| 90.35 | 91.39 |

| 90.21/90.00* | 91.65 |

| 89.7 | 92.03 |

| 88.50* | 92.55 |

EURJPY

Comment: Dropping to the bottom edge of the daily Ichimoku 'cloud' where a weekly close below 132.00 is needed to turn momentum bearish. Lets see if it will drop towards the moving averages at the end of this week.

Strategy: Attempt shorts at 133.00, adding to 134.40; stop above 135.55. Add to shorts below 132.50 and again below 132.00 for 131.00 and then 130.00.

Direction of Trade: →

Chart Levels:

| Support | Resistance |

| 132.85 " | 133.45 |

| 132.52 | 134 |

| 132.00* | 134.4 |

| 131.3 | 135.50* |

| 131 | 136.09 |

Forex weekly analysis

Forex trading sentiment remains at clear extremes, with the vast majority of retail traders long the US Dollar versus the Euro, Japanese Yen, Swiss Franc, and Canadian Dollar. The clear and noteworthy exception is the British Pound; given fairly dramatic weakness, trading crowds have poured into GBP-long positions. Our experience has shown that sentiment extremes typically produce contrarian moves. That is to say, if the vast majority of small FX speculators are long the US Dollar, the currency has often declined. Read below for more in-depth discussions on various US Dollar pairs.

Historical Charts of Speculative Forex Trading Positioning

EURUSD – The ratio of long to short positions in the EURUSD stands at -1.98 as nearly 66% of traders are short. Yesterday, the ratio was at -1.65 as 62% of open positions were short. In detail, long positions are 12.3% lower than yesterday and 17.4% stronger since last week. Short positions are 5.1% higher than yesterday and 12.3% weaker since last week. Open interest is 1.5% weaker than yesterday and 6.4% above its monthly average. The SSI is a contrarian indicator and signals more EURUSD gains.

GBPUSD – The ratio of long to short positions in the GBPUSD stands at 2.20 as nearly 69% of traders are long. Yesterday, the ratio was at 1.24 as 55% of open positions were long. In detail, long positions are 34.5% higher than yesterday and 30.4% stronger since last week. Short positions are 23.9% lower than yesterday and 20.9% weaker since last week. Open interest is 8.5% stronger than yesterday and 3.9% above its monthly average. The SSI is a contrarian indicator and signals more GBPUSD losses.

USDJPY – The ratio of long to short positions in the USDJPY stands at 3.41 as nearly 77% of traders are long. Yesterday, the ratio was at 2.91 as 74% of open positions were long. In detail, long positions are 6.0% higher than yesterday and 2.9% weaker since last week. Short positions are 9.4% lower than yesterday and 12.3% weaker since last week. Open interest is 2.1% stronger than yesterday and 2.8% above its monthly average. The SSI is a contrarian indicator and signals more USDJPY losses.

USDCHF – The ratio of long to short positions in the USDCHF stands at 4.38 as nearly 81% of traders are long. Yesterday, the ratio was at 3.62 as 78% of open positions were long. In detail, long positions are 1.7% higher than yesterday and 11.8% weaker since last week. Short positions are 15.8% lower than yesterday and 0.6% weaker since last week. Open interest is 2.1% weaker than yesterday and 18.1% above its monthly average. The SSI is a contrarian indicator and signals more USDCHF losses.

USDCAD – The ratio of long to short positions in the USDCAD stands at 2.32 as nearly 70% of traders are long. Yesterday, the ratio was at 2.40 as 71% of open positions were long. In detail, long positions are 4.3% lower than yesterday and 27.3% weaker since last week. Short positions are 0.8% lower than yesterday and 10.7% stronger since last week. Open interest is 3.3% weaker than yesterday and 1.8% below its monthly average. The SSI is a contrarian indicator and signals more USDCAD losses.

GBPJPY – The ratio of long to short positions in the GBPJPY stands at 3.94 as nearly 80% of traders are long. Yesterday, the ratio was at 2.12 as 68% of open positions were long. In detail, long positions are 28.0% higher than yesterday and 17.3% stronger since last week. Short positions are 31.1% lower than yesterday and 14.3% weaker since last week. Open interest is 9.1% stronger than yesterday and 7.3% above its monthly average. The SSI is a contrarian indicator and signals more GBPJPY losses.

Crude futures

Crude futures have experienced a sharp selloff over the past 24 hours, collapsing after sinking beneath our previous 1st tier uptrend line. Yesterday’s selloff was accompanied by large sell-side activity, and today is shaping up to be a high volume session as well. Crude futures snapped out of their $68-$72/bbl trading band after weekly inventories registered a spike in supply. The inventory surplus follows data from China revealing a decline in crude imports for the second straight month. Hence, it seems China has satiated its thirst for crude for the time being. In addition to the pulls in supply and demand, we are witnessing a broad-based appreciation of the Dollar. We notice significant declines in the Cable as well as a slight downturn in the EUR/USD and stabilization in the USD/JPY. These catalysts combined with negatively mixed global economic data are driving crude lower towards the psychological $65/bbl level. The ability for crude to base will likely depend on tomorrow’s wave of U.S. economic data, most notably Durable Goods Orders and the Revised UofM Consumer Sentiment numbers. Each release is telling as far as the health of consumption in the U.S is concerned. Any surprise to the downside in tomorrow’s data could drop the S&P futures beneath our important 1st tier uptrend line and knock crude lower. On the other hand, positive economic data would be conductive in helping crude stabilize. Meanwhile, investors should eye the behavior of the Dollar. Further technical setbacks in the major Dollar crosses would place added downward pressure on crude.

Technically speaking, crude’s drop below our previous 1st tier uptrend line and July 30th lows is an important development in our eyes. Crude has likely sacrificed the highly psychological $70/bbl in the process, and investors will now look to $65/bbl as the next psychological play. Crude’s deterioration technically is disconcerting, and could yield a new near-term downtrend if the S&P futures should follow suit. As for the topside, crude now faces multiple uptrend lines, and $70/bbl is serving as a technical barrier now. We are initiating a negative outlook on crude unless the S&P futures should turn and the Dollar depreciate considerably in the wake of tomorrow’s data.

Price: $66.25/bbl

Resistances: $66.84/bbl, $67.13/bbl, $67.52/bbl, $68.08/bbl, $68.74/bbl

Supports: $66.11/bbl, $65.76/bbl, $65.25/bbl, $64.90/bbl, $64.65/bbl

Psychological: $65/bbl, $70//bbl

Gold Drops like a Rock to $1000/oz

Gold failed to get back above previous September highs once again, and is experiencing a large bar down on heightened sell-side volume. The retracement in gold comes in reaction to the collapse of the GBP/USD in addition to a broad-based appreciation of the Dollar. The positive Dollar flows are in reaction to weaker than expected U.S. Existing Home Sales and German Ifo Business Climate data. Additionally, BoE Governor King didn’t wait long to reignite dovish fears, and crude has gotten hammered beneath our important 1st tier uptrend line. The combination of negative events are leading investors away from risk and towards the Dollar, dragging gold down due to its negative correlation with the Greenback. While the Cable and crude have sacrificed their 1st tier uptrend lines, the EUR/USD and the S&P futures are holding strong above their own 1st tiers. However, a full commitment to the downside would likely force a larger pullback in gold. Therefore, the medium-term uptrend is facing its first considerable challenge in quite some time. Hence, investors should keep an eye on gold’s 1st tier uptrend line since it runs through 9/10 lows. A retracement below our 1st tier uptrend line would likely result in a more protracted selloff. Even though gold’s uptrend is still intact, we are initiating a neutral stance until we see how these various interactions with 1st tier uptrend lines pans out. Meanwhile, tomorrow’s wave of U.S. economic data should help determine whether the broad-based downturn accelerates are moderates.

Present Price: $997.95/oz

Resistances: $998.94/oz, $1000.39/oz, $10002.93/oz, $1004.75/oz, $1007.11/oz

Supports: $996.58/oz, $995.13/oz, $993.14/oz, $991.68/oz, $998.78/oz, $986.97/oz

Psychological: $1000/oz

ENERGY MARKET RECAP

November Heating Oil closed down 7.82 at 171.22. This was 0.97 up from the low and 7.49 off the high.

November RBOB Gasoline finished down 7.41 at 164.70, 7.05 off the high and 1.01 up from the low.

November Natural Gas finished up 0.15 at 4.90, 0.02 off the high and 0.24 up from the low.

Technical Outlook

CRUDE OIL (NOV) 09/25/2009: Momentum studies trending lower at mid-range should accelerate a move lower if support levels are taken out. The market's short-term trend is negative as the close remains below the 9-day moving average. The market setup is somewhat negative with the close under the 1st swing support. The next downside target is now at 63.48. The next area of resistance is around 67.68 and 69.81, while 1st support hits today at 64.52 and below there at 63.48.

RBOB GAS (NOV) 09/25/2009: Daily stochastics are trending lower but have declined into oversold territory. A negative signal for trend short-term was given on a close under the 9-bar moving average. The market setup is somewhat negative with the close under the 1st swing support. The next downside objective is now at 158.15. The next area of resistance is around 168.73 and 174.27, while 1st support hits today at 160.67 and below there at 158.15.

HEATING OIL (NOV) 09/25/2009: A bearish signal was triggered on a crossover down in the daily stochastics. Stochastics trending lower at midrange will tend to reinforce a move lower especially if support levels are taken out. The market's short-term trend is negative as the close remains below the 9-day moving average. The close below the 2nd swing support number puts the market on the defensive. The next downside target is 164.39. The next area of resistance is around 175.45 and 181.31, while 1st support hits today at 166.99 and below there at 164.39.

PRECIOUS METALS RECAP

December Gold closed down 15.5 at 998.9. This was 4.9 up from the low and 22.1 off the high.

December Silver finished down 0.615 at 16.295, 0.75 off the high and 0.03 up from the low.

Technical Outlook

COMEX SILVER (DEC) 09/25/2009: Momentum studies trending lower at mid-range should accelerate a move lower if support levels are taken out. The close under the 18-day moving average indicates the intermediate-term trend could be turning down. There could be some early pressure today given the market's negative setup with the close below the 2nd swing support. The next downside target is 1558.8. The next area of resistance is around 1671.0 and 1730.7, while 1st support hits today at 1585.0 and below there at 1558.8.

COMEX GOLD (DEC) 09/25/2009: Declining momentum studies in the neutral zone will tend to reinforce lower price action. The market back below the 18-day moving average suggests the intermediate-term trend could be turning down. The outside day down is somewhat negative. The market is in a bearish position with the close below the 2nd swing support number. The next downside objective is now at 970.9. The next area of resistance is around 1009.8 and 1030.2, while 1st support hits today at 980.2 and below there at 970.9.

CURRENCY MARKET RECAP

December Euro closed down 1.44 at 146.53. This was 0.26 up from the low and 1.49 off the high.

December Japanese Yen finished down 0.1 at 109.64, 1.1 off the high and 0.45 up from the low.

December Swiss finished down 0.71 at 97.12, 0.9 off the high and 0.21 up from the low.

December Canadian Dollar finished down 1.76 at 91.76, 1.64 off the high and 0.42 up from the low.

December British Pound closed down 3.67 at 160.49. This was 0.28 up from the low and 3.37 off the high.

Technical Outlook

JAPANESE YEN (DEC) 09/25/2009: Declining momentum studies in the neutral zone will tend to reinforce lower price action. A negative signal for trend short-term was given on a close under the 9-bar moving average. It is a slightly negative indicator that the close was under the swing pivot. The next downside objective is 108.25. The next area of resistance is around 110.40 and 111.34, while 1st support hits today at 108.86 and below there at 108.25.

EURO (DEC) 09/25/2009: The daily stochastics have crossed over down which is a bearish indication. Daily stochastics turning lower from overbought levels is bearish and will tend to reinforce a downside break especially if near term support is penetrated. The market's close below the 9-day moving average is an indication the short-term trend remains negative. There could be some early pressure today given the market's negative setup with the close below the 2nd swing support. The next downside objective is 145.09. The next area of resistance is around 147.40 and 148.58, while 1st support hits today at 145.66 and below there at 145.09.

STOCK INDICES RECAP

December Dow finished down 82 at 9635, 105 off the high and 35 up from the low.

Technical Outlook

S&P 500 (DEC) 09/25/2009: Momentum studies trending lower from overbought levels is a bearish indicator and would tend to reinforce lower price action. The market's close below the 9-day moving average is an indication the short-term trend remains negative. The market's close below the 1st swing support number suggests a moderately negative setup for today. The next downside objective is now at 1025.35. Short-term indicators on the defensive. Consider selling an intraday bounce. The next area of resistance is around 1055.69 and 1071.34, while 1st support hits today at 1032.70 and below there at 1025.35.

S&P E-MINI (DEC) 09/25/2009: Momentum studies are trending lower from high levels which should accelerate a move lower on a break below the 1st swing support. A negative signal for trend short-term was given on a close under the 9-bar moving average. The market setup is somewhat negative with the close under the 1st swing support. The next downside objective is 1025.25. Daily studies pointing down suggests selling minor rallies. The next area of resistance is around 1055.50 and 1071.25, while 1st support hits today at 1032.50 and below there at 1025.25.

NASDAQ (DEC) 09/25/2009: Momentum studies trending lower from overbought levels is a bearish indicator and would tend to reinforce lower price action. A negative signal for trend short-term was given on a close under the 9-bar moving average. The close below the 1st swing support could weigh on the market. The next downside target is 1668.07. Short-term indicators on the defensive. Consider selling an intraday bounce. The next area of resistance is around 1720.12 and 1748.56, while 1st support hits today at 1679.88 and below there at 1668.07.

DOW (DEC) 09/25/2009: Stochastics turning bearish at overbought levels will tend to support lower prices if support levels are broken. A positive signal for trend short-term was given on a close over the 9-bar moving average. The upside closing price reversal on the daily chart is somewhat bullish. It is a mildly bullish indicator that the market closed over the pivot swing number. The next downside objective is now at 9631. The next area of resistance is around 9782 and 9814, while 1st support hits today at 9690 and below there at 9631.

BOND MARKET RECAP

December 10 Yr Treasury Notes closed up 0-085 at 117-225. This was 0-140 up from the low and 0-075 off the high.

Technical Outlook

BONDS (DEC) 09/25/2009: The daily stochastics have crossed over up which is a bullish indication. Positive momentum studies in the neutral zone will tend to reinforce higher price action. The market's close above the 9-day moving average suggests the short-term trend remains positive. The market has a slightly positive tilt with the close over the swing pivot. The next upside objective is 120-270. The next area of resistance is around 120-160 and 120-270, while 1st support hits today at 119-200 and below there at 119-020.

10 YR TREASURY NOTES (DEC) 09/25/2009: The daily stochastics have crossed over up which is a bullish indication. Stochastics are at mid-range but trending higher, which should reinforce a move higher if resistance levels are taken out. A positive signal for trend short-term was given on a close over the 9-bar moving average. It is a mildly bullish indicator that the market closed over the pivot swing number. The next upside target is 118-110. The next area of resistance is around 118-030 and 118-110, while 1st support hits today at 117-140 and below there at 117-005.

Deputy Treasury Secretary Neal S. Wolin Remarks to Financial Services Roundtable

Deputy Treasury Secretary Neal S. Wolin

Remarks to Financial Services Roundtable

Thank you, John, for that kind introduction. Good afternoon, everyone, and thanks for the opportunity to be with you today.

This is, I think, a particularly important time for you to be gathering – and a particularly opportune moment for me to talk with you about some of the reforms that the Administration has proposed to strengthen our financial system.

One year ago tomorrow, Washington Mutual was closed by the FDIC – the largest U.S. bank failure ever. And of course, it was just over a year ago that Lehman Brothers filed for bankruptcy. In the panic that followed, our financial system nearly ground to a halt.

A swift response prevented a truly catastrophic collapse. But last September's events revealed deep weaknesses in our financial system.

It did not take long for the financial contagion to infect the real economy. When President Obama took office, America's growth rate had hit negative 6.3 percent, and monthly job losses had reached 750,000 - the worst in decades.

There are indications that we have moved back from the financial brink and are headed toward economic recovery. Important parts of the financial system are back to functioning on their own. Some of the damage to people's savings has been repaired. We have taken the first steps towards reducing the government's direct involvement in the system and reducing the risks that taxpayers are bearing.

But we cannot ignore the urgent need for action: our regulatory system is outdated and ineffective, and the weaknesses that contributed to the financial crisis persist. The progress of recovery must not distract us from the project of reform.

The Administration has put forward the most sweeping reform of financial regulation since the New Deal, and we are working closely with Congress to enact legislation by the end of this year.

Our goals are simple: to give responsible consumers and investors the basic protections they deserve; to lay the foundation for a safer, more stable financial system, less prone to panic and crisis; and to safeguard American taxpayers from bearing risks that ought to be borne by shareholders and creditors.

Today, I'd like to focus primarily on one of the key challenges that is at the center of the debate over regulatory reform: how to address the challenge of firms whose failure, absent reform, could threaten the stability of the financial system.

In recent decades, we've seen the significant growth of large, highly leveraged, and substantially interconnected financial firms. These firms benefited from the perception that the government could not afford to let them fail. This perception was an advantage in the market place. Creditors and investors believed that large firms could grow larger, take on more leverage, engage in riskier activity – and avoid paying the consequences should those risks turn bad. It is a classic moral hazard problem.

Of course, during the financial crisis, the federal government did stand behind these firms. That action was necessary, and it was the only option. But there is no question that, unless we enact meaningful reforms, the fact that the federal government intervened this past year will have made the problem worse. We take this moral hazard challenge very seriously. Our proposals for reform address it head on.

First, the biggest, most interconnected financial firms must be subject to serious, comprehensive oversight. The idea that investment banks like Bear or Lehman or other large firms like AIG could escape meaningful consolidated federal supervision should be considered unthinkable from now on.

For the largest, most interconnected financial firms – for any firm whose failure might threaten the stability of the financial system – there must be clear, inescapable, single-point regulatory accountability. The scope of that accountability must include both the parent company and all subsidiaries.

In our view, the Federal Reserve is the agency best equipped for the task of supervising the largest, most complex firms. The Fed already supervises all major U.S. commercial banking organizations on a firm-wide basis. After the changes in corporate structure over the past year, the Fed now supervises all major investment banks as well. It is the only agency with broad and deep knowledge of financial institutions and the capital markets necessary to do the job effectively.

So the first part of our approach to the moral hazard problem is clear, accountable, comprehensive supervision. The second part is tougher standards.

The days when being large and substantially interconnected could be cost-free – let alone carry implicit subsidies – should be over. The largest, most interconnected firms should face significantly higher capital and liquidity requirements.

Those prudential requirements should be set with a view to offsetting any perception that size alone carries implicit benefits or subsidies. And they should be set at levels that compel firms to internalize the cost of the risks they impose on the financial system.

Through tougher prudential regulation, we aim to give these firms a positive incentive to shrink, to reduce their leverage, their complexity, and their interconnectedness. And we aim to ensure that they have a far greater capacity to absorb losses when they make mistakes.

The third key element of our response to the moral hazard problem is to emphasize that being among the largest, most interconnected firms does not come with any guarantee of support in times of stress. Indeed, the presumption should be the opposite: shareholders and creditors should expect to bear the costs of failure.

That presumption needs to have real weight. That means the financial system must be able to handle the failure of any firm. In this last crisis, it clearly was not.

Leading up to the recent crisis, the shock absorbers that are critical to preserving the stability of the financial system – capital, margin, and liquidity cushions in particular – were inadequate to withstand the force of the global recession.

While the largest firms should face higher prudential requirements than other firms, standards need to be increased system-wide. We've proposed to raise capital and liquidity requirements for all banking firms and to raise capital charges on exposures between financial firms.

We've also laid out principles that we believe should guide regulators in setting capital requirements in the future. The core principle is that capital and other regulatory requirements must be designed to ensure the stability of the financial system as a whole, not just the solvency of individual institutions.

Beyond that, we've called for a greater focus on the quality of capital. We've called for capital requirements that are more forward-looking and reduce pro-cyclicality. We've called for explicit liquidity requirements. And we've called for better rules to measure risk in banks' portfolios.

We've also called for measures to strengthen financial markets and the financial market infrastructure. For example, we've proposed to strengthen supervision and regulation of critical payment, clearing, and settlement systems and to regulate comprehensively the derivatives markets.

Our plan would require all standardized derivatives to be centrally cleared and traded on an exchange or trade execution facility – substantially reducing the build-up of bilateral counterparty credit risk between our major financial firms. We would require all customized OTC derivatives to be reported to a trade repository, making the market far more transparent. We would provide for strong and consistent prudential regulation of all OTC dealers and all other major players in the OTC markets, including robust capital and initial margin requirements for derivative transactions that are not centrally cleared.

We should never again face a situation – so devastating in the case of AIG – where a virtually unregulated major player in the derivatives market can impose risks on the entire system.

Taken together, the significance of these reforms should be clear: by building up capital and liquidity buffers throughout the system, and by increasing transparency in key markets, our plan will make it easier for the system to absorb the failure of any given financial institution. The stronger the system, therefore, the clearer it will be that there is no such thing as an implicit government guarantee.

The final step in addressing the problem of moral hazard is to make sure that we have the capacity – as we do now for banks and thrifts – to break apart or unwind major non-bank financial firms in an orderly fashion that limits collateral damage to the system.

Bankruptcy is and will remain the primary method of resolving a non-bank financial firm. But as Lehman's collapse has showed quite starkly, there are times when the existing bankruptcy arrangements are simply not flexible enough, and bankruptcy courts not specialized enough, to deal with the insolvency of large financial institutions in times of severe crisis.

The resolution authority we have proposed gives us another alternative: it allows the government to impose losses on shareholders and creditors without exposing the system to a sudden, disorderly failure that puts everyone else at risk.

As part of our proposal, we've called for firms to prepare what some have called "living wills." We would require major financial firms to prepare and regularly update a credible plan for their rapid resolution in the event of distress. This requirement will leave us better prepared to deal with a firm's failure – and will provide another incentive for firms to simplify their organizational structures.

We believe our proposals represent a comprehensive, coordinated answer to the moral hazard challenge posed by our largest, most interconnected financial institutions: strong, accountable supervision; the imposition of costs, both to deter excessive risk and to force firms to better protect themselves against failure; a strong, resilient, well-regulated financial system that can better absorb failure.

Together, these proposals give us a clear and credible argument that, as the President said two weeks ago in New York, "Those on Wall Street cannot resume taking risks without regard for consequences, and expect that next time, American taxpayers will be there to break their fall."

Before closing, I'd like to touch on another element of our reform proposal that I suspect is of interest to you: the Consumer Financial Protection Agency.

This financial crisis was rooted, in no small part, in a basic failure of our consumer protection regime. Millions of Americans were sold products they didn't understand and couldn't afford. No doubt, many households made irresponsible choices. But there's also no doubt that millions of Americans were misled by unclear disclosures, overly complicated contracts, or loan originators incented to close the deal without regard to the borrower's ultimate ability to pay. The result was tragic – and helped destabilize the entire financial system.

No one can look back at the events of the past two years and say that fundamental reform is unnecessary. And we cannot achieve fundamental reform within the current framework of diffused responsibility, with rule-writing and enforcement divided among a variety of supervisors with different missions and other priorities. We need structural reform.

In designing our reforms, we have been guided by at least two core principles:

First, rule-writing and enforcement should not be separated. We've seen all too clearly that separation of rule-writing authority from enforcement authority leads to inertia, unevenness, and erosion of standards. In addition, a rule-writing agency that lacks the benefit of hands-on supervisory experience will be far less effective. It will lack critical information about market activity and emerging problems. Just as importantly, it may not fully appreciate the burden its rules impose – making it very hard to weigh the costs and benefits of additional regulation.

Second – but closely related to the first – supervisory authority should not be split among various regulators. More specifically, we should not leave banks to be supervised by one agency or set of agencies and non-banks by another. If we do, standards will ultimately diverge, and market activity will migrate towards the lower standards. There must be a level playing field.

A single, independent consumer protection agency is essential to satisfy those core principles. The CFPA will have the authority to write and enforce rules to promote transparency, simplicity and fairness – for all market participants.

The CFPA will also be charged with promoting innovation, choice and fair competition. We value deeply America's vital tradition of innovation, and we reject the false choice between innovation and consumer protection. We believe that the surest way to promote innovation is to promote trust. Consumers who trust that the market is well regulated – that all financial firms will play by the rules and treat them fairly – will make the choices that best suit their needs. And successfully matching consumer needs is, in the end, the highest goal of innovation.

We are not interested in dictating business plans. We are interested in making sure that consumers have the information they need to make informed choices.

So let me just close by saying this:

There is room for honest differences on the details of the plan we have put forward – on our response to the challenge of moral hazard, on the CFPA, on many elements of our plan. It would be impossible to put forward six hundred pages of legislative language and expect full agreement from everyone.

But one year after the breakdown last September, there should be no disagreement that reform is urgently needed. It is time to bring our financial regulations into the twenty-first century. I hope that you will join with us to build a stronger, safer financial system. It's in your interest, as leaders of the financial services sector. It's in your customers' interests. And it's in America's interest.

We welcome the opportunity to continue working with you on this critical legislation.

Thank you.